You can buy a share of Tesla instantly on your phone, but buying a share of any company not traded on the public markets can cost thousands in legal fees and take weeks to close. This lack of liquidity is a long-standing struggle for private market shareholders. For the most part, many stockholders of private companies are left holding shares until some kind of liquidation event, like an IPO or an acquisition. Companies like EquityZen and SharesPost have tried to establish a stock exchange for the private markets, but transaction volumes remain fairly low on these platforms. There's still opportunity out there to bring together investors and shareholders into an improved, trusted marketplace.

Enter Carta. Carta was founded all the way back in 2012 by Henry Ward, who serves as CEO. Over eight years they've lined up all the ingredients to put together an exchange that, in the words of board member and VC Marc Andreesson, could "transform the private markets". Fresh off a $300M Series E led by a16z, Carta has been at work creating "CartaX", a mission to "to democratize access and liquidity to some of the world’s fastest growing assets."

The journey didn't come easy and challenges remain, but if CartaX works, it would open up dozens of new opportunities, and could change startups and venture capital for good.

Humble Beginnings and Big Growth

Carta started off with a simple product: an easy way for private companies to automatically track changes and equity details on their cap table. The ability to view all these equity holdings in a simplified way was a big improvement over "lawyers with spreadsheets", but the market was very niche.

Their cap table management business was growing, but the full picture hadn't yet come in to focus. In 2016, they started a 409A valuation service, helping companies put together reports on equity value required by the IRS. These two business lines were still somwhat niche and weren't really well-synergized, but they were a powerful wedge to get at something much bigger.

Carta was becoming the system-of-record for asset ownership. They were building a powerful network, working their way into both sides of any exchange (investors and companies), and setting themselves up to do something much bigger. The more products and services it offers, the more reasons companies have to standardize on Carta’s platform; the more startups that adopt Carta, the more likely investors will bring the rest of their portfolios to it. This positive feedback loop allowed them to grow rapidly and embed themselves within private companies, and a variety of investors.

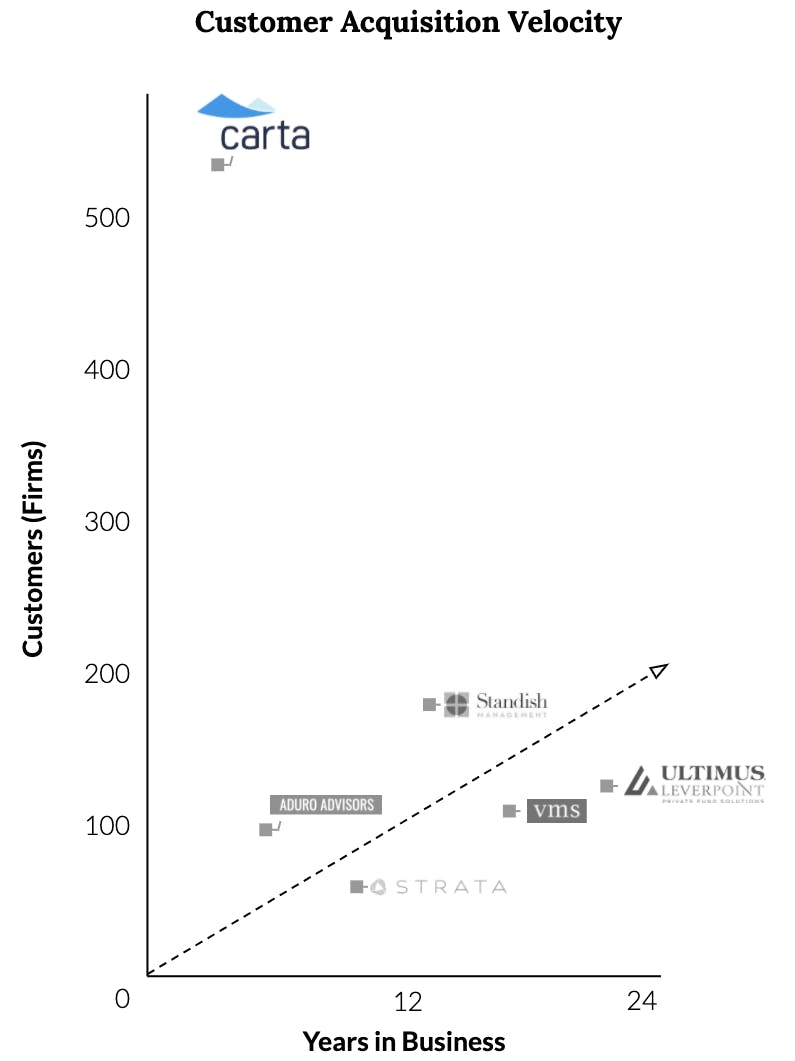

In that spirit, they also launched a hugely successful free portfolio management and paid fund administration service for investors ranging from VC firms to LLCs to hedge funds. This graph, from Tribe Capital, shows how fast they acquired customers relative to other fund admin providers.

Their fund management system is growing 2.7x year on year, and some investors are even adding stipulations in term sheets that founders use Carta for equity management. Impressive growth, to be sure. However, there's skepticism as to whether or not their rumored $1.7B valuation is justified, given that they're still serving a niche market. Has Carta just took a bunch of moderately lucrative businesses, and bundled it together?

Carta X: the Final Form

Carta argues they've collected the pieces to build a transparent, highly liquid stock exchange for the private markets.

Now more than ever, there's a clear need for such an exchange. Private funding has outpaced IPO funding for years now, companies are staying private for much longer before IPO'ing, and according to data from the National Bureau of Economic Research, there are fewer companies trading publicly now than there were 40 years ago, shrinking from nearly 5,000 to about 3,500 in 2016. Most of the U.S. is missing out on the vast amounts of wealth creation happening before companies go public, if they ever do. In fact, over 90% of all American households don't qualify as "accredited investors" due to lack of assets — meaning under the current system, they don't even have the chance for directly building wealth in the private market.

In addition, more and more employees own equity in their companies as businesses try to align incentives to benefit high-talent workers that stay with a company for a long period of time. But employees actually need a way to access that money, and ever-increasing time horizons for liquidation limit employee mobility and generate burnout.

Traditional solutions often lack the necessary transparency, or are time-consuming and can involve dozens of bankers and lawyers.

CartaX could solve all this in a way that previous solutions haven't been able to quite do right. CEO Henry Ward explained why in an interview with Cheddar: "Now we know all the owners, the shareholders, the employees of this company, and we also are the transfer agent, or the settlement platform, so now we can trade across these things,” said the CEO. “We know all the market participants." As of April 2020, according to Tribe Capital (disclosure: they're Carta investors), there are over 15,000 companies on Carta, and 1M stakeholders (entities that own equity on Carta) interconnected with $1T USD in equity on the platform. That's a very powerful network. Details on how exactly CartaX would run are scarce, but it would likely involve online auctions of private shares — something theoretically possible but difficult to do without the level of reach Carta has.

What if it Works?

Given Carta's sizable war chest and deep access into the private marketplace, if anyone can pull off a transparent, liquid, high-volume private exchange, it's probably Carta.

In a new world where private companies can effortlessly run controlled auctions, a lot would change for startups and their investors. Here's what could change, as well as new questions raised by this platform:

- VC's could, in theory, easily exit their positions from companies earlier without pressuring founders to work towards a traditional liquidation event. How does this change the VC- founder relationship?

- If companies can get some of the benefits of being publicly traded while still being private, could there be even less IPOs in the future?

- Early employees would have a path to cashing out some or all of their shares before any liquidation, enabling greater worker mobility and flexibility.

- Does this make offering equity to employees more valuable to a company, or less? It benefits the employees, but the idea of equity-based compensation is to align incentives for the long-term.

- Data from existing private market stock exchanges suggests that equities traded on these platforms trade at a significant discount compared to when they IPO, in part due to lack of information. How can the platform make the trade valuable and fair for equity holders?

- Rise of new, private funds that focus on finding deals at CartaX auctions

- Opportunities for companies that collect and produce research on private companies that are listing equities on the exchange. Since private companies aren't required by the SEC to disclose financial information, that's definitely a challenge that needs to be solved for the marketplace to work.

- How does a company fairly offer equity-based compensation to its' employees in a world with CartaX?

- Opportunities to analyze and assess these transactions for investors

Nothing is guaranteed, but it's clear that Carta has built the pieces needed to make a private stock exchange work in a way that other companies in this space haven't been able to do as well. Founders and investors should keep their eyes on CartaX. Should it succeed, it would change the startup world in big ways.

Disclosure: Nothing presented within this article is intended to constitute legal, business, investment or tax advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Contrary LLC (“Contrary”) nor does such information constitute an offer to provide investment advisory services. Information provided reflects Contrary’s views as of a time, whereby such views are subject to change at any point and Contrary shall not be obligated to provide notice of any change. Companies mentioned in this article may be a representative sample of portfolio companies in which Contrary has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Contrary. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results. A list of investments made by funds managed by Contrary (excluding investments for which the issuer has not provided permission for Contrary to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at www.contrary.com/investments.

Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Contrary. While taken from sources believed to be reliable, Contrary has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Please see www.contrary.com/legal for additional important information.